technology

reseller.co.uk

CUSTOMER EXPERIENCE

37

Reality check

New report highlights gap between business perceptions and

the customer experience

an education client we would provide

independent content and run groups on

LinkedIn and through social media, so you

could talk to buyers in other schools. Not

everything has to be moderated by us,”

he said.

“On the PR side, the aim is to focus

activity on certain verticals. Every two or

three months we will choose a different

vertical sector to focus on depending

on what activities are going on in the

market place. For example, in the run-up

to the BETT show, we would focus on the

education sector and produce relevant

content for buyers in schools.”

Amid mounting evidence of a

disconnect between the quality of the

customer service organisations think

they provide and what their customers

actually experience (see below), there is

a clear need for a certification scheme

based on independent client feedback.

By providing buyers with a quick and

easy way to find reputable suppliers

with relevant experience and satisfied

customers, techtick removes much of

the fear, uncertainty and doubt from the

supplier selection process. For suppliers

themselves, it provides independent

validation of their commitment to

customer service and a way to differentiate

themselves from competitors who make

claims they can’t back up.

A new report from Capgemini’s Digital

Transformation Institute highlights a

positive correlation between investment

in digital customer experience initiatives

and the satisfaction of customers and

their willingness to spend more.

Based on an international survey of

more than 3,300 consumers and 450

company executives,

The Disconnected

Customer: What digital customer

experience leaders teach us about

reconnecting with customers

highlights

a gap between how businesses and

consumers perceive the quality of their

customer experience.

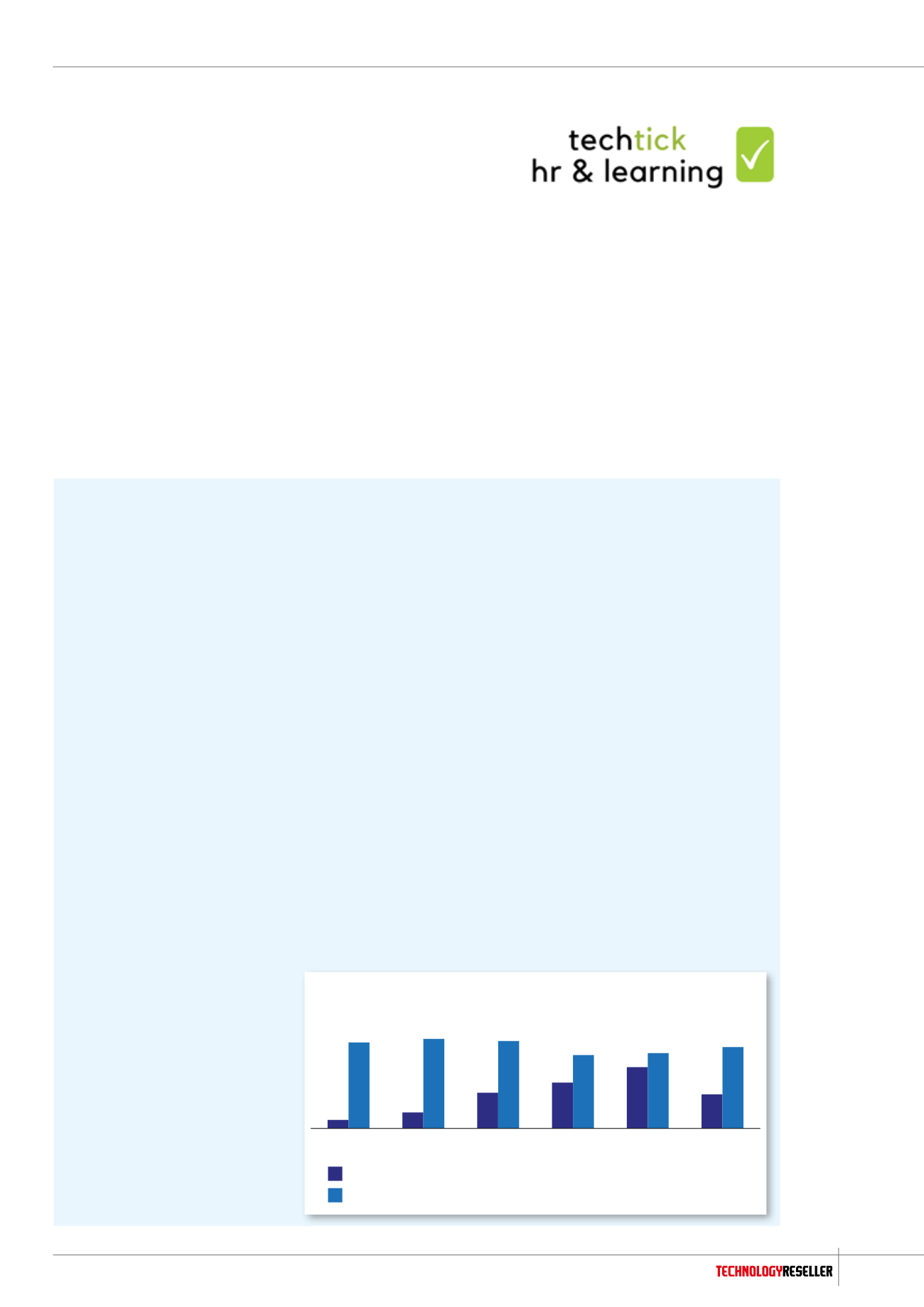

For example, while 74% of businesses

describe themselves as customer-centric,

only 30% of consumers agree with this

perception.

The gap between business and

consumer perceptions is narrowest

for internet-based services, with just

12 points between the percentage of

companies who believe themselves to be

customer-centric and the percentage of

companies whose consumers believe they

are customer-centric (68% vs 56%).

This compares to a 71-point gap for

utilities (78% vs 7%) and a 47-point gap

for retail (79% vs 32%).

The report shows that many businesses

are also over-optimistic about customers’

willingness to recommend their products

or services, measured by the Net Promoter

Score (NPS). While 90% of businesses

believe their NPS has increased by 5

points in the last three years, only 54% of

consumers agree.

Businesses that invest in technology

to narrow the gap between their own and

their customers’ perceptions can look

forward to increased loyalty and business,

with 81% of consumers surveyed saying

they would increase spend in return for a

better experience. Almost one in 10 (9%)

say they would increase their spend by

more than half.

The digital experience

Capgemini argues that investment to

improve the digital experience should be

a key area of focus. Its Digital Customer

Experience (DCX) Index, which rates

business performance across 80 digital

experience attributes, shows that the

higher the DCX Index score, the greater the

willingness of consumers to spend money

with and recommend a business.

Analysis shows that for each single

point increase in the DCX Index score,

consumers would be willing to spend 0.6%

more with an organisation and the NPS

would go up by nearly 5 points.

Companies that closely link their

business operations with the customer

experience (6%) enjoy a 14-point NPS

advantage over those in which business

operations are not connected to the

customer experience (33%).

Currently, just 19% of organisations

are meeting consumers’ digital experience

expectations. Those that aren’t face a

number of challenges including the rapidly

evolving technology landscape (56%);

rising consumer expectations (57%); the

difficulty of integrating disparate platforms

(38%); poor user interfaces (32%); and

a lack of dedicated customer experience

budgets (41%) and internal ownership of

the digital customer experience (35%).

membership in multiple technologies and

sectors.

Building awareness

The success of techtick will depend on

its ability to attract a sufficient number

of end users to the website. To this end,

it will also provide independent content

with advice on business technology and

the procurement process and a no-frills

directory of non-approved suppliers, so

that in areas where there is not yet an

approved reseller, users can still find

useful information. In addition, Ogden

plans to run a rolling PR and social media

programme to raise awareness in specific

market sectors.

“Our aim is to try and become known

in certain areas. For example, if you are

7%

14%

32%

42%

56%

30%

78%

81%

79%

67%

68%

74%

CPG

Retail

Bank Internet-Based

Services

Overall

Utility

Percentage of companies whose consumers believe they are customer centric

Percentage of companies who perceive themselves to be customer centric

Consumer and company perception of customer centricity

– by Industry