Basic HTML Version

www.binfo.co.uk

16

magazine

Many small and medium business (SMB)

organisations are already using financing in

their business, whether this is for company cars,

coffee and snack vending machines or office

printers, photocopiers and scanners. However,

information and communications technology

(ICT) financing and leasing has not had the

same success, even though it can help to iron

out peaks and troughs in ICT budgets and help

to create a better, longer-term ICT strategy that

is optimised to support a business.

New research from Quocirca sponsored by

BNP Paribas, a leading provider of leasing finance,

with102 SMBs in the UK, provides new insights into

views on various aspects of the use of financing

and leasing of ICT hardware and software and

comparisons with existing use for other areas such

as vehicles and office equipment.

For the research report titled ‘Using ICT

financing for strategic gain’, Quocirca asked

respondents their general views on financing and

leasing, and their thoughts about ICT financing

in particular. The results reveal that many SMBs

are unaware how ICT financing works, preferring

to spend cash on ICT purchases. The research also

revealed that few resellers include a finance option

during sales negotiations.

A key finding from the research include that the

majority of SMBs expect IT budgets to shrink this

year. More than 64 per cent of respondents expect

technology budgets to decrease in 2013, with a

further 21 per cent expecting them to stay level.

Through financing, this available budget can go

much further.

Acquisition costs are a key consideration for

SMBs in new IT projects. Over half of respondents

consider up-front costs to be of critical or high

concern in their procurement process. Through

financing there is no capital outlay, meaning this

concern is allayed immediately.

Many SMBs buy technology ad-hoc, mainly

online. 41per cent of respondents use value added

resellers (VARs) as their main channel for buying

ICT hardware and software. However, some 81per

cent use the internet as either their primary

or secondary means of procurement. Ad-hoc

purchasing could actually increase ICT costs in the

long term, where financing can help SMBs make

more cost-effective and strategic ICT investments.

Few SMBs use ICT financing, while fewer still

understand the benefits of it.While 76 per cent of

respondents currently use car financing, only 30

per cent are using financing for IT and telephony

equipment. Just 1per cent are using it for software

– with some 40 per cent never having considered

software financing at all. To compound this, more

than 50 per cent of respondents are unaware of

the benefits of IT finance in comparison to a cash

purchase or bank credit lines, while just fewer than

40 per cent believe financing is unnecessary as they

have enough cash already. This demonstrates that

much more must be done to help SMBs understand

the benefits of ICT financing, and how it allows

valuable cash reserves to be invested in supporting

core, strategic objectives.

advertorial

Financing ICT

equipment for SMBs

nancing ICT equipment for SMBs

any small and medium business (SMB) organisations are already using financing in their business,

ether this is for company cars, coffee and snack vending machines or office printers, photocopiers and

anners. However, information and communications technology (ICT) financing and leasing has not had

e same success, even though it can help to iron out p aks and troughs i ICT budgets and help to create

etter, longer-term ICT strategy that is optimis d to support usiness.

w research from Quocirca sponsored by BNP Paribas, a leading provider of leasing finance, with102

Bs in the UK, provides new insights into views on various aspects of the use of financing and leasing

ICT hardware and software and comparisons with existing use for other areas such as vehicles and

fice equipment.

r the research report titled ‘Using ICT fina c or strat gic gain’, Quocirca asked r spondents t eir

neral views on financing and leasing, and their thoughts about ICT financing in particular. The results

veal that many SMBs are unaware how ICT financing works, preferring to spend cash on ICT

rchases. The research also revealed that few resellers include a finance option during sales negotiations.

key finding from the research include that the majority of SMBs expect IT budgets to shrink this year.

ore than 64 per cent of respondents expect technology budgets to decrease in 2013, with a further 21

r cent expecting them to stay level. Through financing, this available budget can go much further.

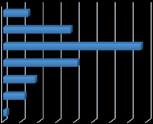

pected 2013 ICT budgets

quisition costs are a key consideration for SMBs in new IT projects. Over half of respondents consider

-front costs to be of critical or high concern in their procurement process. Through financing there is no

pital outlay, meaning this concern is allayed immediately.

any SMBs buy technology ad-hoc, mainly online. 41per cent of respondents use value added resellers

ARs) as their main channel for buying ICT hardware and software. However, some 81per cent use the

0%

5%

10%

15%

20%

25%

30%

35%

40%

Increase by more than 10%

Increase by 5-10%

Increase by between 1 and 5%

Roughly stay the same

Decrease by between 1 and 5%

Decrease by between 5-10%

Decrease by >10%

benefits of IT finance in comparison to a cash purchase or bank credit lines, while just fewe

cent believe financing is unnecessary as they have enough cash already. This demonstrates

more must be done to help SMBs understand the benefits of ICT financing, and how it allo

cash reserves to be invested in supporting core, strategic objectives.

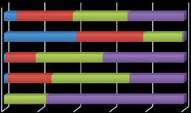

Current use of financing

Many ICT vendors hardly mention financing when discussing deals – if at all. The option t

deal is brought up regularly in around 30 per cent of ICT purchasing negotiations, while in

conversations it’s never brought up at all. The conclusion has to be that ICT financing does

be top of mind for many SMBs. However, the research presented in this report indicates tha

0%

20%

40%

60%

80%

100%

Company cars

Telephony systems

Office equipment

IT software

IT hardware

Not considered

Considered but not used

Considered and used in the past

Currently using

Expected 2013 ICT budgets

Current use of financing